Georgia’s healthcare market is estimated to worth more than c.GEL 4 billion in 2021. The total healthcare market last five years’ estimated compound annual growth rate was 8%. According to the World Health Organization total health expenditure (current + capital) in Georgia in 2000-2019 demonstrated one of the fastest growth dynamics among the peer group of countries with CAGR at 11.1%. In relative terms, expressed by health expenditure as a percentage of GDP, Georgia achieved the level of major developed economies (c.8%), which is above most of the peer emerging economies.

However, there still remains a vast potential for further increase since Georgia has one of the lowest per capita expenditures on healthcare among the benchmark countries. Healthcare spending per capita is currently at a very low base of only US$308, with annual outpatient encounters of 3.8 per capita and a hospital bed utilisation rate of only 49%, all significantly lower than many comparable countries. Management believes that there are strong prospects for growth in healthcare expenditure, driven by both supply and demand.

Healthcare service providers (both state and private) generate revenue from out-of-pocket payments (including fee-for-service and the UHC co-payments), transfers from state healthcare programmes and payments from private medical insurance companies. Pharma companies’ revenue generation is primarily driven by out-of-pocket retail revenue of the pharmacies, together with wholesale revenues from hospitals, insurance companies and the state. Medical insurance companies depend on revenues from medical insurance policies purchased by employers for their employees and by individuals for their own use. Out-of-pocket expenditure on healthcare in Georgia still exceeds public financing and private insurance, as there is very limited financing of pharmaceutical products by the state and are mostly out of pocket paid. The share of private expenditure in total healthcare expenditure in Georgia is around 60% (out-of-pocket c.55%), the share of Government expenditure around 38% and the remaining 2% comes from other sources.

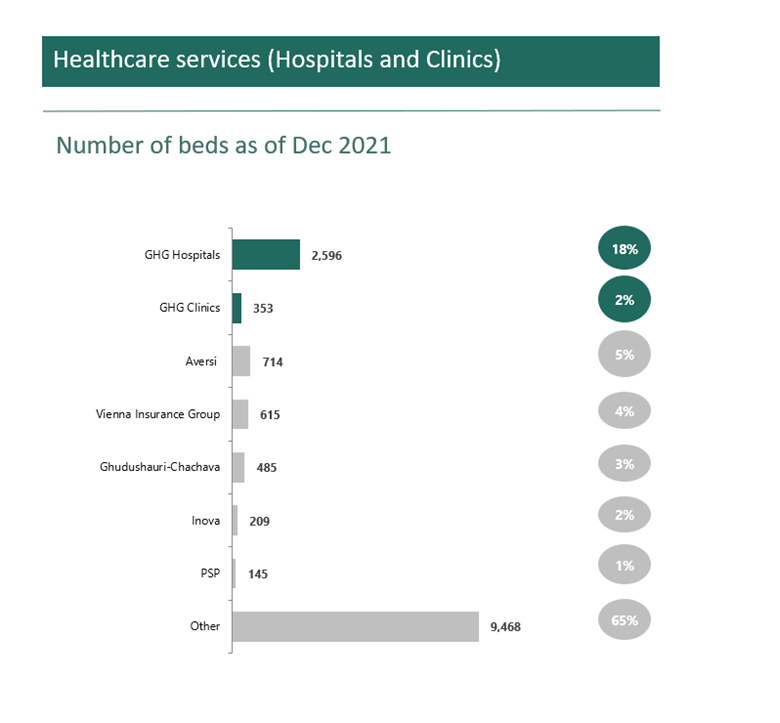

Both state and private healthcare providers (clinics and hospitals) compete in the Georgian market, with private providers accounting for the vast majority of the country’s total supply. The market is relatively fragmented, with the six largest competitors (all of which are private) accounting for only 35% of the total number of beds in the country. This may indicate further growth potential for both new and incumbent market participants through mergers and acquisitions. The outpatient clinics market is even more fragmented and no competitor controls more than a 1% market share, with the Group’s own market share at 2%. Therefore, it is likely that there will be further consolidation and emergence of a large participant in the market via mergers and acquisitions.

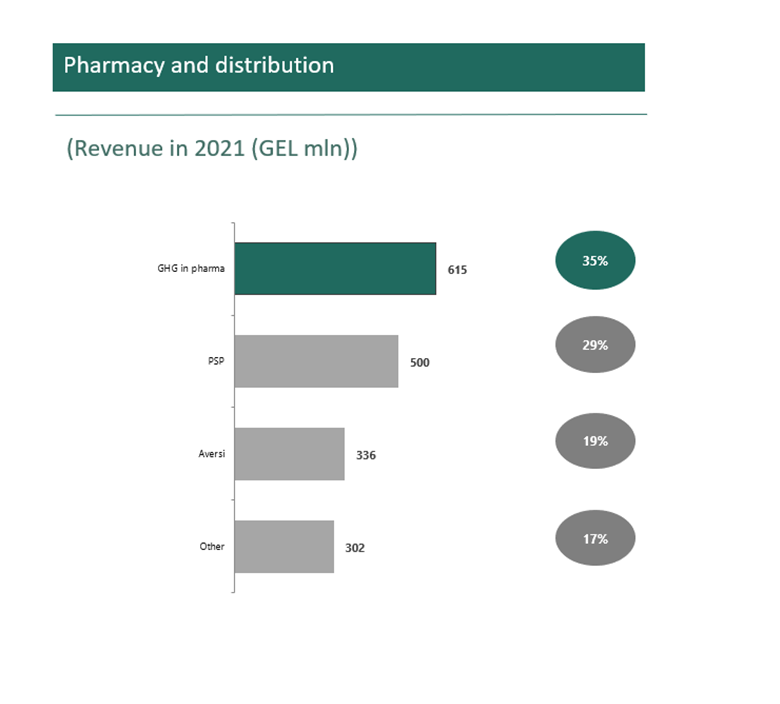

The pharmaceutical market in Georgia is highly concentrated, with three major players holding approximately 83% of the market share. Two main competitors in the pharma market are also present in the hospital and medical insurance markets, with much smaller market shares than GHG. GHG, therefore, remains the only large player across all these markets as the competitors have not managed so far to establish scalable businesses in all respective sectors.

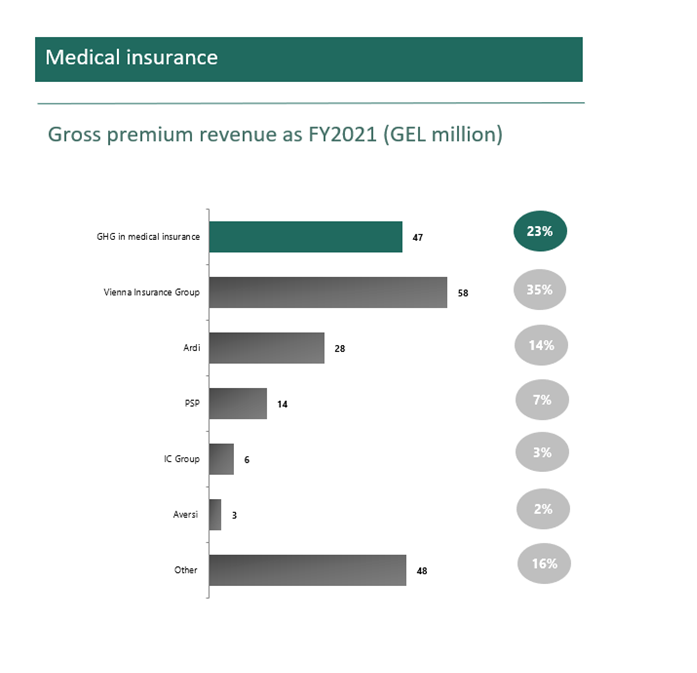

As of 31 December 2021, 609,000 private medical insurance packages have been reported to the Insurance State Supervision Service of Georgia. The Georgian insurance market is represented by 18 companies, 15 of which operate in the health insurance segment. The market is highly concentrated, with the top three companies holding a 72% market share by Gross Premium Revenues (“GPR”). After winning the recent tenders and increasing its client base starting from 2019, our Medical Insurance business gained more than one-third market share by revenue and became the country’s largest medical insurer.

A Government-funded healthcare programme that provides basic healthcare coverage to the entire population, was introduced in March 2013. It eventually replaced the existing two State Insurance Programmes (“SIPs”). UHC is an undertaking by the Government to reimburse healthcare providers directly for the delivery of treatment to patients. The programme is subject to certain limits and service coverage exclusions, beyond which the patients have to fund treatment on an out-of-pocket basis or rely on a private medical insurance coverage.

In November 2019, there has been change in UHC when Georgian Government has reduced certain tariffs on intensive care and cardiac services in Tbilisi and Kutaisi regions, which have developed an oversupply of beds as a result of addition of a number of small hospitals, to equate them with the tariffs set for the rest of the regions

Since the introduction of the UHC Programme, its budget more than doubled from GEL 338 million in 2014 to GEL 754 million in 2019, accounting for c.70% of all state healthcare expenditure. Elective inpatient services and emergency services constitute the major part of the UHC budget, while outpatient services have a limited coverage. The remaining 30% of the state healthcare budget was allocated to vertical healthcare programmes, such as dialysis and cancer screening. In 2020 UHC budget is estimated at GEL 802 million and budgeted at GEL 800 million in 2021, decreasing the share of UHC in total state healthcare expenditure to c.50% due to the increased cost of vertical programmes which since 2020 includes the expenditure for managing and treating patients with COVID-19.

Financing and top-up mechanism

• The UHC is fully financed by the Government from tax revenues and administered by the Social Service Agency (“SSA”) – a body under the Georgian Ministry of Labour, Health and Social Affairs (“MOH”).

• The UHC doesn’t reimburse 100% of costs in most cases, leaving substantial room for out-of-pocket payments by patients.

• The UHC coverage for citizens is based on their income level.

Beneficiaries and providers

• UHC beneficiaries may select any healthcare provider enrolled in the programme.

• Actual prices charged to patients by healthcare providers are not regulated by the State.

• Any provider, whether private or public, is eligible to participate in the programme.

• Population income growth and rising health awareness. Economic growth in Georgia is expected to outperform most of the developed and CIS countries. The International Monetary Fund (IMF) expects the Georgian economy to expand by 3.2% in 2022, and forecasts the economy to grow by 5.3% in 2023-2027, representing one of the highest projected growth rates in the region. Rising population incomes and awareness supported by Government efforts to develop preventive medicine will create growth opportunities for the polyclinic segment.

• Filling the service gaps – growth of private investment in technology and equipment. While Georgia has achieved remarkable success in certain fields of healthcare, some areas remain underdeveloped and there are a number of service gaps in the country. Many laboratory tests are still performed abroad. There are two PET/CT scanners in Georgia, while at least four are required to comply with the WHO recommendations. There are also shortages of the following equipment: laparoscopic instruments, equipment for interventional endoscopy, including endoscopic retrograde cholangiopancreatography, microwave tissue ablation systems, arthroscopes, choledocoscopes, muscle reinnervation systems, intraoperative ultrasound probes, vacuum machines, Flowtron mechanical compression units, pH metre units, and intraoperative neurophysiology and navigation systems in neurosurgery. Private investment in high-technology equipment should strengthen local capabilities, increase the number of procedures and improve the quality of care.

• Growth in the number of outpatient visits. Georgia lags behind most of the developed countries in terms of the number of outpatient visits per capita. This is partially explained by cultural differences (practices of self-treatment, and distrust of outpatient service providers). However, with growing private investment in this segment, expected market consolidation and Government support, the market will see growth in outpatient visits, which will positively impact the polyclinics’ revenues.

• Growth of hospitalisation rates. There is at least 15% growth potential in the hospitalisation rate, which is likely to depend on market consolidation, the pace of introduction of new technologies and development of local skills.

• Supportive Government healthcare policies. Since its introduction in March 2013, the UHC has made basic healthcare available to the entire population and is expected to maintain increase in demand for medical care, particularly hospital services. The Government budget on healthcare is expected to decelerate to 2.9% of GDP in 2022, as the COVID-19 pandemic related expenses shrink, albeit remain higher than the pre-crisis level of 2.7%.

• Growing awareness of the benefits of medical insurance among the Georgian population. This may lead to a greater demand for private medical insurance from employers and self-paying customers who seek better quality services, quicker treatment or more advanced procedures than those covered within the UHC framework. However, the new Government initiative introduced in 2017 – excluding individuals with annual income of over GEL 40,000 (c.32,000 people) from the UHC coverage and granting only a limited UHC coverage to middle income citizens, i.e. those with an income of over GEL 1,000 per month but under GEL 40,000 per year (c.400,000 people) – is intended to make the UHC spending more efficient and may potentially expand the private medical insurance market.

• Strong growth in healthcare expenditure. On a per capita basis, healthcare spending remains low compared with certain emerging market peers (such as Malaysia and the UAE) pointing to further growth potential. At the same time, economic growth and rising disposable incomes of Georgian citizens, including those living outside the capital city, should also lead to higher spending on pharma and healthcare services, particularly considering the potential increase in the number of corporate medical insurance plans for employees.

• Demographics. The country has an ageing population, with an increasing proportion of its citizens aged over 60 (as per the latest UN Population Division data, the share of people aged 60+ in Georgia will increase to 24% by 2025 from 20% in 2015), who will require more frequent, better and prolonged treatments. Increasing incidence of certain lifestyle-related diseases (hypertension, ischemic heart diseases, cerebrovascular diseases, and diabetes) will also boost demand for medical care and medicines. In addition, healthy fertility rates will drive demand for obstetric and childcare services.

• Development of medical tourism in the medium to long term. Improving facilities and standards have the potential to develop health tourism by attracting the citizens of the neighbouring countries and, conversely, retaining the Georgians currently seeking treatment overseas in the long run. The country is also highly price competitive compared with other medical tourism destinations and possesses unique natural resources (climate, mineral waters). The number of tourists in Georgia reached a record high of 5.1 million in 2019, up 7% y-o-y. Some potentially attractive segments for medical tourism may be IVF, plastic surgery, ophthalmology, transplantology, orthopaedics and oncology.